"Bulls Regain Footing Quickly From Last Rally Failure?"

or "Fifth Times A Charm On The Fourth?"

7/4/2022

Happy Fourth! Hope you are as proud to be an American as I am. I tell people, like many do, I hit the lottery when it comes to the country of my birth. And then I hit the Powerball number landing in Hawaii with Hawaiian ancestry and attending the Kamehameha Schools! Pretty blessed.

Calling the bottom for this correction has been a clear exercise in futility, but luckily so far the gains in the short-lived rallies have exceeded the give backs for the year. I still believe when the rally does lift no one will believe it till it has gotten away and then the FOMO chase begins. Magnitude depends on how much institutional stock still left to sell. Can’t be much?

The rally failure last Tuesday healed smartly into the end of the week. I actually put funds back to work for Friday (July 1 second best trading day of the year) and added more for tomorrow, due mainly to afternoon rallies Wed/Thu/Fri. Since April every reversal day has led to a lower low in most indices/sectors. The late week buoyancy is a check mark back on the bullish side of the ledger.

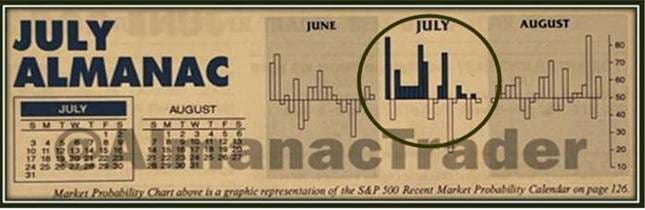

And historically the first half of July is very positive, especially for the NASDAQ up 29 of past 37 years. You gotta like those odds! Assessing probabilities has become key as the QE Bull Market ends.

A potential leader for the coming rally could be the best performing sector of the year, Energy. Putin Price Hikes has ignited a return of 31.5% for the first half, and that is after the sector fell 21% the last three weeks! A Positive MACD Divergence has formed that could help Energy regain its place as market leader. Most important is Exxon, Chevron, Conoco, and all components have a similar bullish look. Collectivity is confirming as the more the merrier.

The Exploration Index made a new recent low last week with a rising MACD as well. This might be an indication the Biden Administration is willing to ease regulations to increase production? One can hope. The Natural Gas Index is also flashing a positive divergence. Often pullbacks like this are followed by a retest of the previous high, which would be a very robust rally for the group. I am overweighted this sector currently.

Commodities in general which have benefited from inflation fears, but have had a rough June. The Commodity Tracking ETF DBA ran into a double digit correction just since mid-month. It too formed a positive divergence adding to the bullish backdrop.

The security I’m watching closely is the US Dollar. Equities and the $ have developed a near 90% inverse relationship since the correction began. I showed this X marks the spot chart a month ago and the relationship persists. Look close as the currency dropped during the short lived equity rallies.

The world reserve currency sits at a technical crossroad currently. A negative divergence is clearly in play, but momentum points to new highs? The greenback is up 17% since June ‘21 and this is an unusually strong move for a currency. Kills our exports. The move needs a respite and the divergence fires IMO with equities benefiting. Significant new highs in the $ would be a fly in my ointment.

CONCLUSION

Back in the Bull corral. Many say Mr. Market intends to confound the most and this year is quintessentially confounding. Too much short interest, sideline cash, pessimism, and Wall of Worry not to produce a meaningful rally at some point. Why not now?

With the addition of oil and other recently oversold commodities (metals are constructive too) forming bullish divergences we may be resorting to the good ol’ days of 2020 when we were deep in an Everything Rally! The backdrop sure appears set up for the move. This is only the fourth time I have made this call since April. The failed rallies are probably (I don’t believe anyone knows for sure?) a consequence of the Fed removing the punchbowl (liquidity injections) swiftly and suddenly. Only sell signals failed during the decade long Bull run.

If you scroll down to previous missives you will see more indicators which held their head in Tuesday’s reversal. Again these failures could leave sideline cash flat footed when the rally sparks. It is a good feeling to be long when the crowd is chasing.

FINAL THOUGHT

More later,

Matt Pavich

Disclaimer: Remember everything I said could be wrong, the market always has the last word. Matt Pavich makes no guarantee or warranty about what is advertised above. Max Power is neither a registered investment firm nor a broker/dealer. We urge you to always conduct your own research and due diligence and obtain professional advice before making any investment/trading decisions. We will not be liable for any loss or damage caused by a reader’s reliance on information obtained on this page or corresponding web sites.